The G20 Monitor has been built by FNA as a winning response to the G20 TechSprint challenge for Dynamic Information sharing for Supervisors and Regulators in Response to Crises. The solution sources both structured and unstructured publicly available information relevant to the stability of the financial system, and displays this information, accompanying analytics and modelling in a set of monitors.

The application has been designed to provide instant access to a range of data and analysis across all Suptech areas of application. We believe that this will facilitate stronger coordination amongst regulatory and supervisory agencies, and will support them in formulating and implementing coordinated cross-jurisdictional responses to systemic risks, especially at the time of unprecedented disruptions from the COVID-19 crisis.

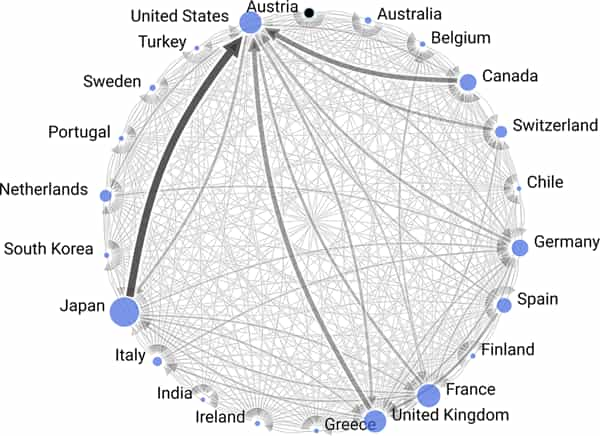

We live in an increasingly interconnected world. Central Banks and Supervisors need to gain insights from massive amounts of new supervisory data as well as data available in a plethora of online sources. The financial crisis of 2007-08 showed the critical importance of taking financial interdependencies into account from a systemic risk perspective.

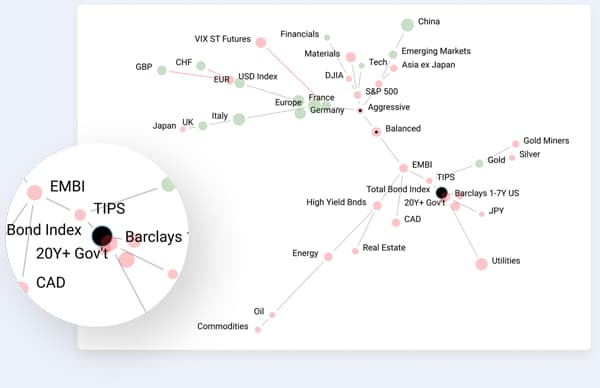

Today we can map various interconnections with network analytics and model contagion with simulation methods. This allows us to identify hidden risk concentrations and develop new predictive models of risks.

FNA is a deep technology company and award-winning leader in Regulatory Technology (Regtech) and Supervisory Technology (Suptech). FNA combines industry leading data science capabilities with deep central banking and supervisory expertise.

The FNA Platform allows financial authorities to map and monitor complex financial networks and to simulate operational and financial risks. FNA’s clients include the world’s largest central banks, supervisors, GSIBs and financial market infrastructures.

FNA’s mission is to make the financial system safer and more efficient.